We often come across the term “Enterprise Developers” and even more often, we ask ourselves questions about their profile, from basic demographics to purchasing decisions. But who is an Enterprise Developer? According to SlashData, large enterprise developers as those who work for organisations with between 1,000 and 5,000 employees and very large enterprise developers as those who work for organisations with more than 5,000 employees. Non-enterprise developers are those that remain.

How many enterprise developers are out there?

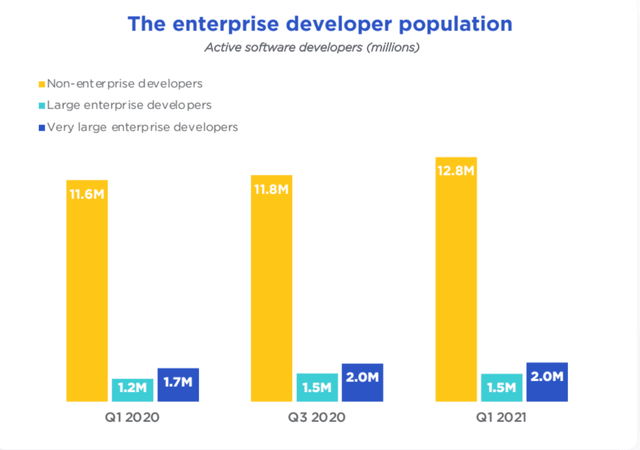

In Q1 2021, SlashData estimated that there are 1.5M enterprise developers working in large organisations, and 2.0M working in very large enterprises. Between Q1 2020 and Q1 2021, there was a 21% year-on-year growth in the large enterprise population, while the very large enterprise population increased by 18%. This is impressive growth, considering that the non-enterprise population showed only 10% growth over the same period. However, for the large and very large enterprise population, the immediate picture is one of stability: in the last six months, it has remained practically unchanged. Considering that the biggest tech companies an important proportion of very large enterprises have benefited from the economic situation caused by the pandemic, it is somewhat of a surprise that the very large enterprise population hasn’t increased. Perhaps there is a backlog of hiring splurges that have yet to show up in the data or these companies are remaining cautious and waiting to see how the pandemic plays out before committing to hiring more employees.

Where in the world are they located?

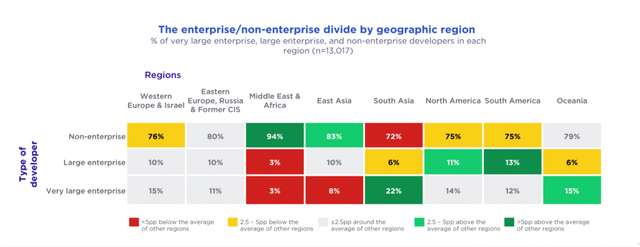

If we break down the enterprise populations by region, we find that 22% of software developers in South Asia are very large enterprise developers. These enterprises are likely using their global connections to capitalize on price here: the median per-hour cost for Android development in India, a large hub for app development, is $30. In North America, the rate is five times as high. For example, SAP, the largest non-American software company by revenue, has based its largest R&D lab outside Germany, in India. In absolute terms, most developers working at very large enterprises are to be found in North America (27%) and Western Europe (26%). South Asia takes third place, with 17% of all very large enterprise developers working in this region. North America, Western Europe, and East Asia are the stage for large enterprises, with 28%, 24%, and 17% of the large enterprise population respectively.

Which sectors or industries are they working on?

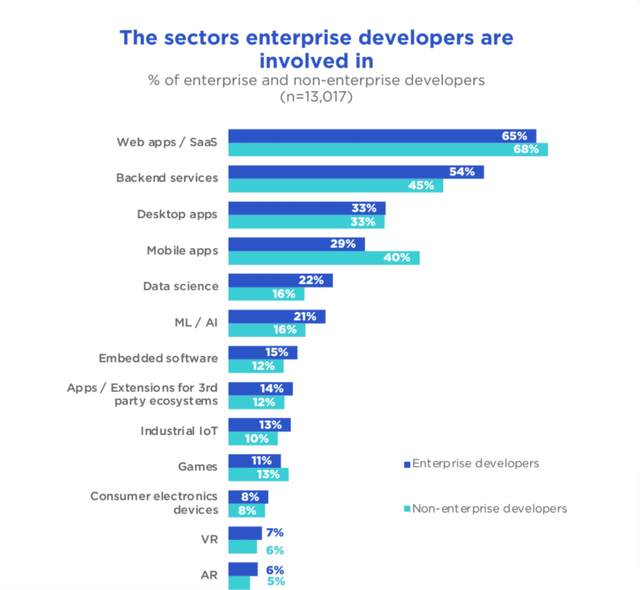

Most developers are involved in web apps: more than 6 out of 10 developers are involved in the sector. However, developers are often involved in more than one sector. In fact, around three-quarters of developers are involved in more than two sectors, while around 15% engage in five or more sectors. Besides web apps, enterprise developers are dominated by their involvement in the backend sector: 56% of very large enterprise developers and 51% of large enterprise developers

work in this sector. This is compared to the 45% of non-enterprise developers who work in the backend sector. Enterprise businesses typically have more sophisticated

needs that warrant engaging backend developers. With the myriad of resources at their disposal, enterprises are more easily able to develop large-scale, connected products with complicated backends, IoT devices, for example. Backend

developers are required to achieve these goals.

The opposite trend is observed in mobile apps: 40% of non-enterprise developers work in this field, while just under a third of enterprise developers do. The relatively short scope and scale of mobile app development make small business engagement in this sector achievable. For enterprise companies a mobile app, or a web app, is only one small part of a giant machine of software; but for smaller organisations, the mobile or web app might be the entire product. Web apps, backend services, and desktop apps the top three sectors enterprise developers are involved should be explored in greater detail.

Attitudes and engagement

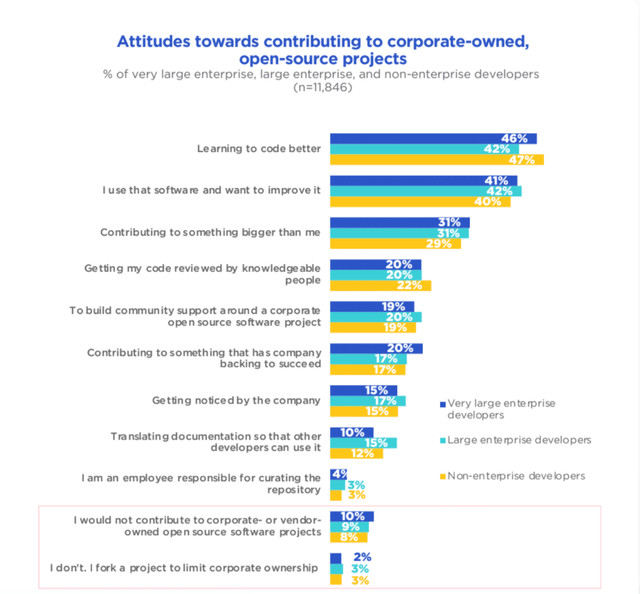

Open source has become a ubiquitous part of developer culture, embodying the widely venerated values of sharing code, knowledge, and best practices among peer developers. These days, many open source projects are vendor or corporate owned and maintained. Developer attitudes towards contributing to these open source projects differ, but across the non-enterprise/large enterprise/very large enterprise divide these differences are subtle. Large enterprise developers are slightly more likely to contribute to corporate-owned, open source to improve their positions in the software food chain: 17% are motivated by their desire to get noticed by the company.

Meanwhile, very large enterprises are slightly more likely to

have developers buy into the company ethos: 20% of developers working at these organisations wish to contribute to something that has the company's backing to succeed.

Non-enterprise developers tend to favour reasons relating to improving their skill set: 47% wish to learn to code better. Compare this to large enterprise developers, of whom 42% are motivated by learning to code better. Around one-fifth of all developers are united by the desire to build community support; while just under a third of all developers advocate for a more open software society, contributing to corporate-owned, open-source projects because it’s “something bigger than me”. However, moving from attitudes to economic engagement, the differences between large, very large, and non-enterprise developers tend to be more pronounced regarding practical engagement within an organisation.

“Those who control the money”

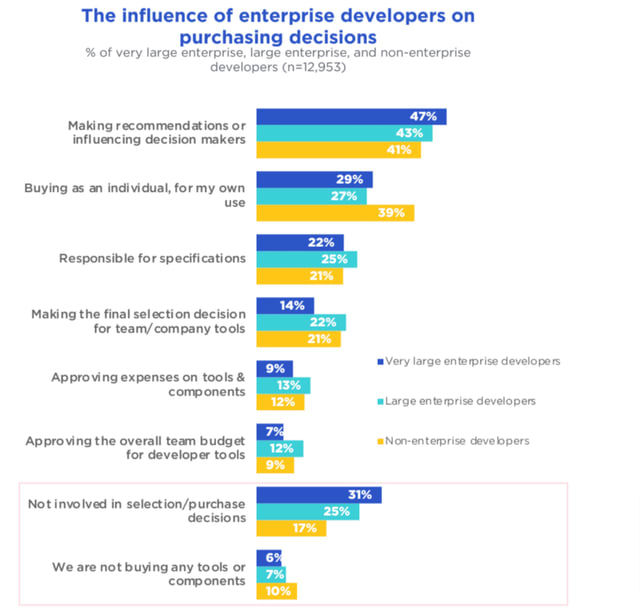

There are many tiers of enterprise developers: these range from those high up in a business hierarchy that makes or influences purchasing decisions, down to developers who are not involved at all in these selections. The breakdown of developers according to economic decision-making power within an organisation differs across the non-enterprise/large enterprise/very large enterprise divide.

Just over a quarter of large enterprise (27%) and non-enterprise developers (26%) are economic decision makers for their team or company, with the ability to make the final

selection decision for tools, approve expenses on tools and components, and/or approve the overall team budget for tools. Not all of these economic decision-makers can approve budgets or expenses, but whether they are decision-makers for their team or company, they are all empowered to make tool selection decisions.

Comparing these segments to very large enterprises, where only 18% of developers can make purchasing decisions, demonstrates that decision-making power tends to concentrate at the top of the hierarchy in larger organisations. In agreement with this analysis, 31% of developers who work at enterprises are separate from purchasing decisions. In comparison, this drops to 25% and 17% for large and non-enterprise developers, respectively.

So are you an Enterprise Developer?

Did you see yourself fitting in the data above? Then you probably are an Enterprise Developer. If you want to help the ecosystem grow, you can take part in our Enterprise Cloud Developer Experience Survey. Start Here

Top comments (0)