Venmo is one of the biggest digital wallet players in the industry. It enables users to swiftly pay, split, and share their experience on digital platforms. Uber, Poshmark, Forever21 are some of the top companies that have integrated Venmo into their products. The platform allows social payments, mobile payments, P2P payments, and text message payments.

One of the key reasons for Venmo’s popularity was its simplicity. It started in 2012 - when the FinTech revolution was just in its infancy. Venmo eventually added QR code payments, ACH payments, bank accounts, and card integration. While Paypal now owns the platform, it disrupted the digital finance ecosystem.

Chime is another FinTech company that is making waves in the industry. It is an online neo-bank that offers no-fee mobile banking solutions to its users. Chime partners with multiple regional banks to create customer-first products. It provides an online marketplace for banking products to customers not previously served by traditional banks.

Today, Chime has a client base of over 12 million users. It provides customers access to bank accounts with quick paycheck facilities and overdrafts and augments their credit. Chime is making banking easier than ever before, and since it doesn’t have any physical branches, there’s no need for expense in maintaining the infrastructure as well.

(Source: Tectic)

The Growth of the FinTech Market

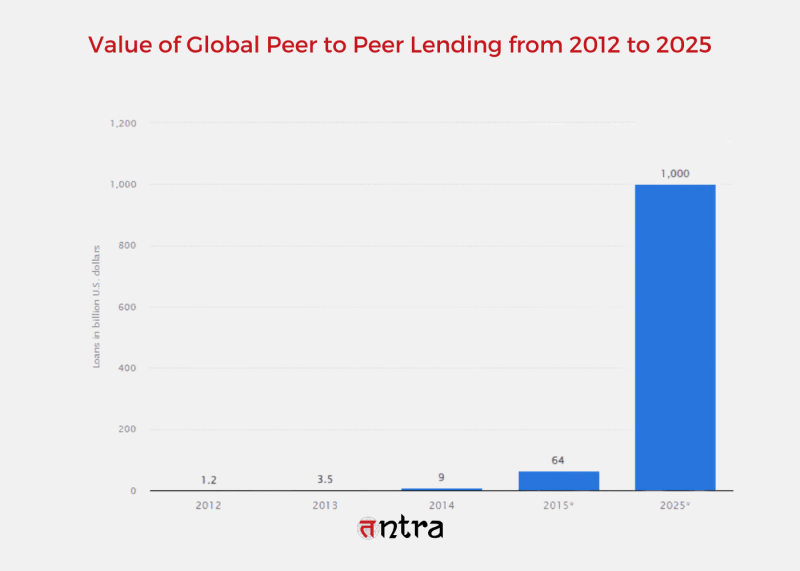

Digital P2P lending is expected to reach $1 trillion by 2025. P2P lending is one of the major drivers of financial inclusion. P2P helps lenders and borrowers without the intervention of banks, making it easier for people to get loans and utilize finance for their needs.

40% of financial companies believe that Blockchain Technology will transform how financial services are delivered. Blockchain simplifies transaction management by providing complete transparency and enabling users to view what occurs on a particular network.

More than 65% of banking executives believe digital wallets and mobile payments will greatly impact the financial industry. More and more people are now switching to digital wallets for convenience and ease of payment.

Read more: Is FinTech all About Cryptocurrency: Myths About FinTech Industry

5 Key FinTech Trends That Will Shape 2023

The FinTech digital transformation is here, and startups and FinTech technology consulting services are making the most of it. The FinTech global market is rapidly expanding, and newer ways to deliver digital finance are coming into the picture.

From enterprise FinTech solutions to FinTech super apps, the industry is increasingly welcoming innovative models and FinTech strategies. As a result, several FinTech app ideas are also making their way to disrupt the industry this year.

Here are some of the key FinTech trends that will shape the landscape in 2023 -

1. Decentralized Finance

- Companies are using Blockchain financial technology to bring Decentralized Finance (DeFi) to the center of the FinTech sector. Through Blockchain, companies are bringing transparency and eliminating intermediaries from financial transactions. In 2023, Blockchain will continue to rise as companies focus more on P2P lending and providing FinTech services from neobanks.

2. Digital Banking

- While digital banking may have been in existence for a while, 2023 will witness an unprecedented usage of digital banking services. Traditional banks are now transforming into digital-first branches to compete with the neo-banks and FinTech startups that are eliminating banks as middlemen. With a mobile app today, anybody can access banking services without visiting the branch.

3. RegTech

- Another of the key FinTech trends in the implementation of RegTech is to ensure the safe and secure delivery of financial services. It reduces the cost of transactions and multiplies compliance and regulation. RegTech will also enable efficient monitoring of financial institutions, which will result in fraud prevention.

4. Contactless Payments

- Contactless payments will easily become the norm as consumers move toward a digital-first financial landscape. It provides them convenience and safety from traditional methods of payments. In addition, contactless payments from mobile phones and smartwatches will also drive a new era of embedded finance that will transform the industry.

5. Digital Wallets

- One of the first trends in FinTech was digital wallets, which are still going strong. It simplifies payments for users across the globe. With the introduction of Blockchain, digital wallets have taken an entirely new meaning. They will provide users with easy access to money and enable the development of a truly financially inclusive landscape. Digital wallets are all set to become the most sought-after FinTech trend in 2023.

Listen to the insightful podcast on IndiaStack and the future of Fintech with Tntra. Stay ahead in the world of finance and technology! Don't miss out on this insightful conversation on FinTech Podcast.

Conclusion

FinTech app development services are rising due to the latest developments and trends in the FinTech industry. A software product engineering company like Tntra engineering is re-engineering the FinTech market by building products that match today's trends. Every FinTech solution today is now integrated with new technology that disrupts the industry. 2023 will be an exciting year for the FinTech sector as new and better innovations emerge. It will be interesting to see where the Fintech world goes from there.

Contact Tntra FinTech experts today!!

Top comments (0)