EBITDA and EBIT is a very fundamental financial term that is nowadays mostly considered during the cloud adoption phase for IT companies. If your company is planning to migrate to cloud and you are going to present a finance key performance index to your CFO then make sure you learn these concepts.

Broadly for any company there exist 3 types of financial statements as following:

- Balance sheet

- Income or Profit & Loss (P&L) Statement

- Cache Flow Statement

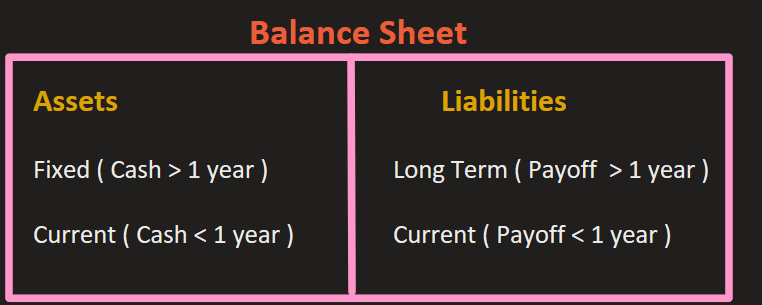

What is a Balance Sheet?

Balance Sheet consists of Assets and Liabilities.

Assets are of 2 types Fixed and Current Assets. Fixed Assets which you get the cash value after 1 year example real estate, building, equipment, vehicles. Current Assets which you convert into cash within 1 year

Liabilities are 2 types: Long Term and Current. Long Term liabilities which you have to start paying after 1 year. Current liability which you have to pay off within 1 year.

What is an Income or Profit & Loss (P&L) Statement?

If you subtract your company Expenses from Revenue then you get the profit.

Profit = Revenue - Expenses

The profit that you make as cash is added to the Current Assets in your Balance Sheet. So if you make more profit your cash reserves increase that increases your assets as well.

What is a Cash Flow Statement?

A Cash Flow Statement is just like your bank account statement that shows how much money is credited (deposited) or debited (withdrawn) from your bank account.

Net Cash Flows = Cash In - Cash Out

Cash In could be in any form of money deposit to your bank account it could be loan, income revenue, friend deposit money. Cash out could be any form of withdrawal from your account for any reason. The net balance of your cash is the net cash flows of your account.

EBIT & EBITDA is a metric of Profit and Loss statement that explains which company stock is good and which company is performing better at an operational level.

Amortization vs Depreciation

Tangible assets are physical assets that can be touched. Example of Tangible assets are as follows:

- Buildings

- Equipments

- Furnitures

- Vehicles

- Land

- Machinery

Depreciation is the expense of a fixed asset over its useful life.

Intangible assets are not physical assets, they can not be touched. Example of Intangible assets are as follows:

- Patents

- Franchise agreements

- Organizational Costs

- Proprietary process such as copyrights like purchasing cost of software license

- Bonds

- Employees of a company

Amortization is the practice of spreading an intangible asset’s cost over that asset’s useful life.

What is Non Operational Expenses?

Non operational expenses are the variables that differ company by company. Majorly below 3 categories of expenses are called non-operational expenses:

- Interest - Depends on the company’s Financing Structure. If a company has taken a large loan then interest is high and vice-versa.

- Taxes - Depends on Geography

- Depreciation & Amortization - Past Investments. Non-Cash Expense

What is EBIT & EBITDA?

EBITDA means Earning Before Interest, Tax, Depreciation and Amortization.

EBITDA = Gross Profit - Operating Expenses

EBIT = EBITDA - Depreciation + Amortization

PBT = EBIT - Interest

Net Profit = PBT - Tax

EBIT = Net Profit + Interest + Tax

EBITDA = Net Profit + Interest + Tax + Depreciation + Amortization

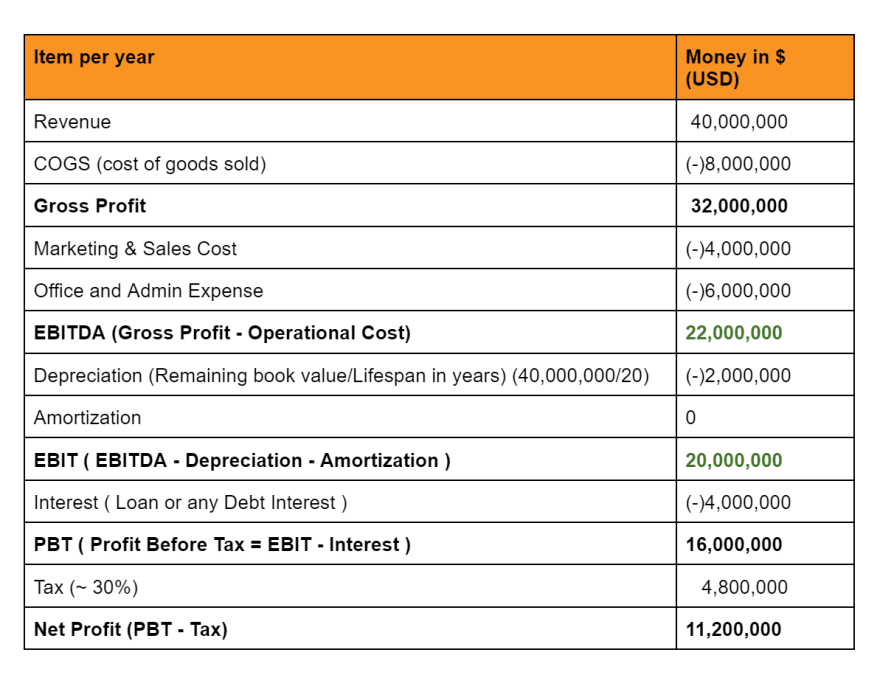

Vehicle Manufacturing Company EBITDA & EBIT Statement

Why is EBITDA important for a company?

The Net Profit of a company doesn’t describe the financial status of a company. Because, non operational expenses such as Interest, Tax component, Depreciations, Amortizations vary per company. Example some companies might have no loan so no interest so they might show more net profit. Other companies have taken larger loans so their interest rate is high so net profit becomes low. Taxes can change as per geographical area. Depreciations may differ per company based on old/new physical assets. Therefore, you should financially compare companies at operational level only.

In order for creating a Level Playing Field you will use EBIT & EBITDA which is used to compare companies on their operational costs. That is the recommended way to identify which company is financially stronger.

EBITDA is mostly considered in heavily capitalized industries like telecommunications, manufacturing, oil & gas etc. industries.

EBIT is mostly used for service oriented industries like Consulting and Technologies.

Why do C-Level Executives care more about EBITDA?

Because when you move your company to cloud then you get rid of capital expenses and incur more operational expenses. As capital expenses decrease and operational expenses increase the EBITDA value decreases. In most of the companies C-level executives like CFO, CIO, CEO get incentives, bonus based on EBITDA value. If EBITDA decreases then their bonus money gets reduced. However, IT companies also have data center staff expenses that are being calculated as the operational cost. Since that costs are now reduced or completely removed based on how many data centers your company closes. That value can balance out the EBITDA value and make your c-executives happy in terms of financial bonus money.

Conclusion

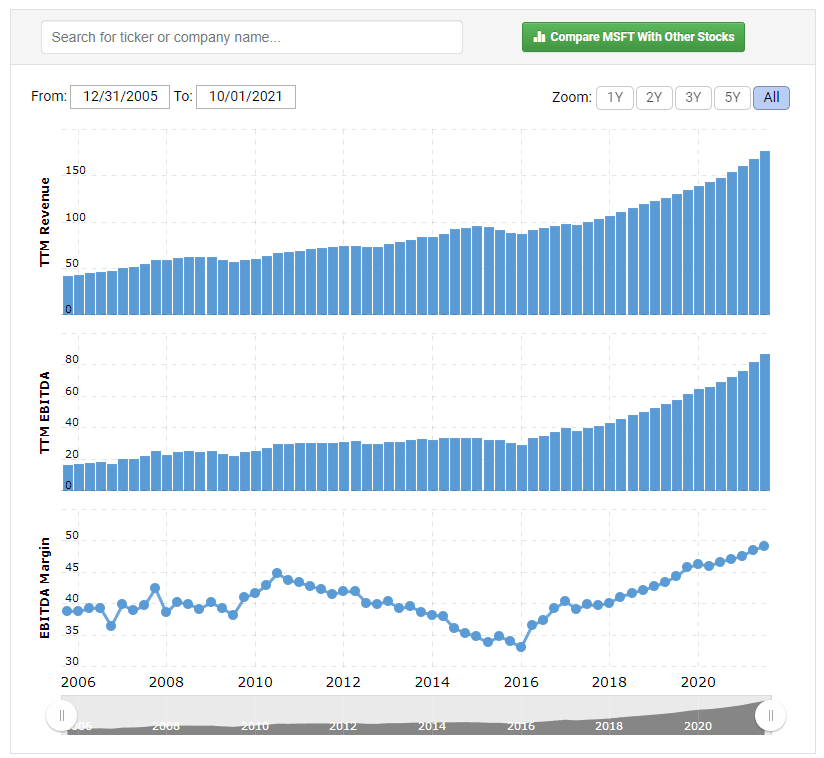

So EBITDA is the term used by many software IT industries to publish their financial growth. You can check Microsoft Azure EBITDA margin over the last 10 years here in this chart

Thanks for reading my article till end. I hope you learned something special today. If you enjoyed this article then please share to your friends and if you have suggestions or thoughts to share with me then please write in the comment box.

💖 Say 👋 to me!

Rupesh Tiwari

Founder of Fullstack Master

Email: rupesh.tiwari.info@gmail.com

Website: RupeshTiwari.com

Top comments (0)